Ethan's Head Start: Securing a Bright Future from Day One

Introduction

At 30 and 32, Jamie and Alex welcome their first child, Ethan, into the world. Drawing from their own financial experiences and successes, they decide to start a savings program for Ethan right from birth. They choose a whole life insurance policy, not only as a savings vehicle but also to lock in his insurability at a young age.

The Early Start for Ethan

Jamie and Alex commit to saving $6,000 annually for Ethan, starting from when he's just an infant. This approach isn't just about building a fund for Ethan; it's also about teaching him the value of financial planning from an early age.

Using Whole Life Insurance

The choice of a whole life insurance policy provides Ethan with lifelong coverage and a savings component that grows over time. It's a dual-purpose tool: a safety net and a potential source of funds for major life events.

The Power of Compound Interest

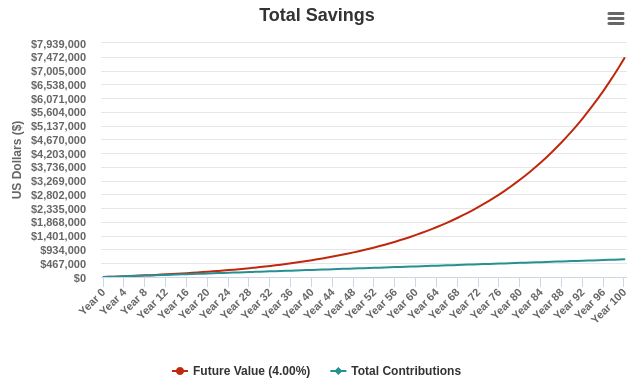

With a conservative estimate of a 4% IRR, let's see how Ethan's fund grows at different stages of his life:

At Age 22 (College Age):

Ethan's fund has grown to approximately $191,694. This can support his education or serve as a kick-start for his financial independence.

At Age 30 (Early Career Stage):

The fund reaches about $281,473, offering a substantial financial buffer or investment capital as he enters a new life stage.

At Age 62 (Typical Retirement Age):

Ethan’s fund stands at $1,002,592. This substantial amount can significantly contribute to a comfortable retirement.

At Age 85 (Late Retirement):

The fund grows to an impressive $2,229,892. This not only ensures a secure retirement but also allows Ethan the opportunity to leave a financial legacy.

Conclusion

Jamie and Alex’s decision to start early for Ethan showcases the incredible impact of long-term saving and compound interest. Ethan's whole life insurance policy is more than a safety net; it's a financial tool that grows with him, offering flexibility and security throughout his life.

Empowering the Next Generation

This story of Ethan's early financial journey is a testament to the importance of starting early and the lifelong benefits that can follow. If you're inspired to give your children a similar head start, reach out to us to explore how you can integrate smart saving strategies into your family's financial plan.