Alex's Awakening: Embracing Financial Maturity at 30

Introduction

Every financial journey is unique, filled with its own set of choices and lessons. In this narrative, we explore the story of Alex, who, unlike Jamie, embarked on his financial path with a different mindset and set of experiences.

Meet Alex

Alex, at 24, was just beginning to navigate the world of personal finance. Unlike Jamie, who started saving diligently at 22, Alex's approach was more relaxed. He saved only about 5% of his income, often prioritizing immediate experiences and indulgences over long-term financial planning.

Alex’s Lifestyle Choices

With a penchant for the finer things in life, Alex treated himself to a sleek BMW and dabbled in the stock market. While these decisions brought short-term excitement and lessons, they did not significantly contribute to his financial growth.

The Turning Point

At 28, Alex met Jamie. As they grew closer and eventually married, Alex was inspired by Jamie's disciplined approach to savings and her growing financial stability. Witnessing the fruits of her consistent efforts, Alex, now 30, realized the importance of reevaluating his financial strategies.

Embracing Change

Understanding that he needed to catch up, Alex decided to overhaul his financial habits. He recognized that to match Jamie's trajectory, he would have to save more aggressively due to his later start.

Alex’s New Financial Plan

- Alex increased his savings rate significantly, aiming to set aside a larger portion of his income.

- He reevaluated his spending habits, cutting down on luxury expenses and redirecting those funds into savings.

- Alex also sought to educate himself more deeply about investment and savings strategies, learning from both his and Jamie’s experiences.

The Power of Starting Now

Despite beginning his savings journey at 30, Alex is determined to make the most of his time. Let's break down the numbers to understand his situation better:

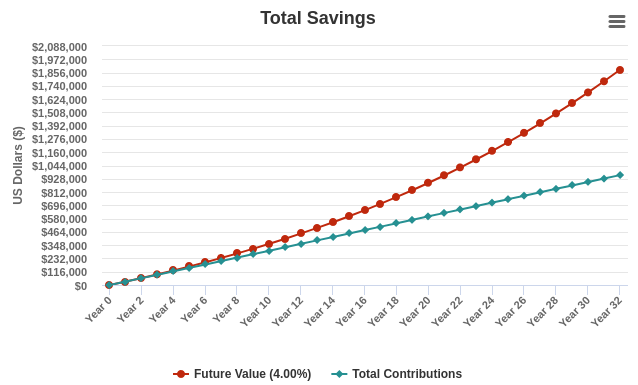

Scenario 1 - Matching Jamie's Monthly Savings: If Alex starts saving $2,500 per month at age 30 and achieves a 4% IRR, by the time he reaches 62, he will have accumulated $1,881,044.06. While this is a substantial amount, it's almost $1 million less than what Jamie will have at the same age. This difference starkly highlights the cost of delayed financial planning and the power of compounding over time.

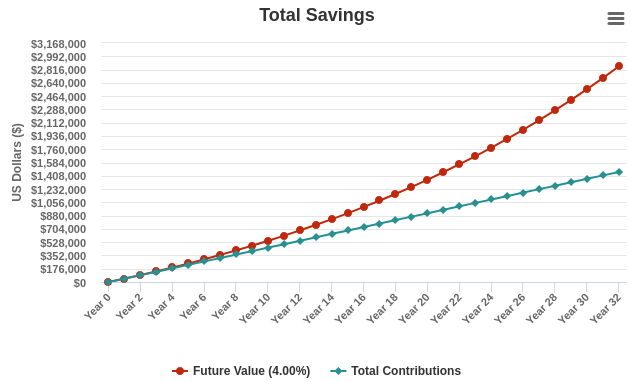

Scenario 2 - Aiming for a Comparable Outcome: To align his savings more closely with Jamie's expected amount at age 62, Alex calculates that he needs to save approximately $3,800 per month. This increased contribution would grow to about $2,859,186.97 by the time he is 62, closely mirroring Jamie's projected savings.

Recognizing the significance of these numbers, and with their finances now combined post-marriage, Alex commits to the higher savings rate of $3,800 per month. This decision underscores a key financial principle: while it's never too late to start saving, the earlier you begin, the less you have to save each month to reach the same goal.

Conclusion

Alex's journey is a relatable tale of financial maturity and the power of adaptability. His story shows that while an early start like Jamie’s is advantageous, a willingness to learn and adapt can also pave the way to financial security.

Alex’s Message

For those who see a bit of themselves in Alex, remember: your financial path is not set in stone. It's about the choices you make from this point forward. Embrace the lessons from your past and use them to inform a brighter financial future.

Alex’s story is a compelling reminder that while starting early like Jamie provides a head start, financial success is still achievable with dedication and a strategic approach, no matter when you start.