Introduction to Behavioral Finance: Why Smart People Make Irrational Money Decisions

Have you ever wondered why successful, intelligent people sometimes make questionable financial decisions? Perhaps you've caught yourself making an emotional investment choice that you later regretted. The truth is, our brains aren't wired to always make rational financial decisions, and understanding why could transform how you think about money.

The Tale of Two Financial Theories

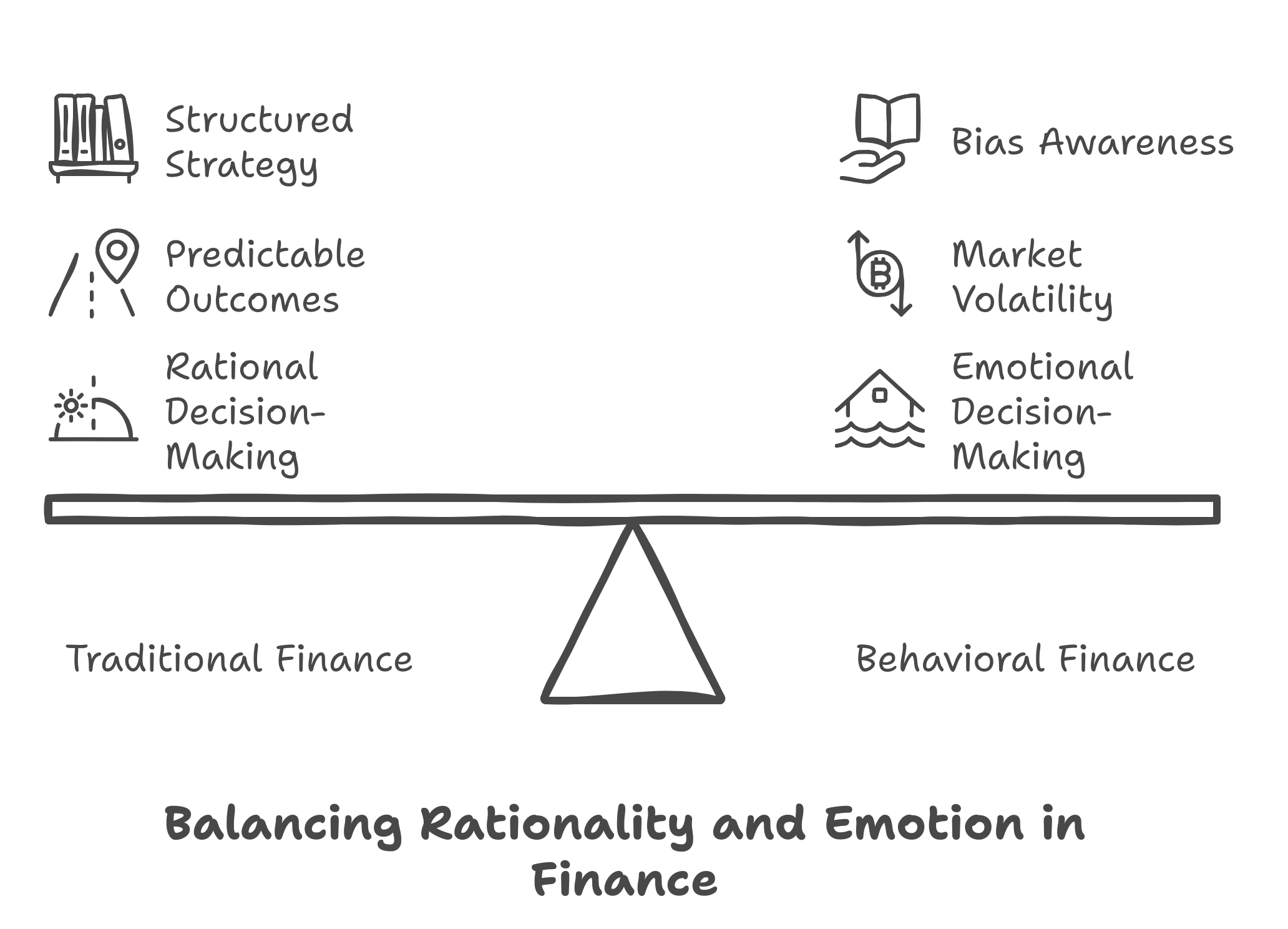

Traditional finance theory has long assumed that we're all rational beings who carefully analyze every financial decision to maximize our wealth. This view, known as neoclassical economic theory, suggests that markets are efficient and that investors always act logically, carefully weighing all available information before making decisions.

But anyone who has ever panic-sold during a market crash or held onto a losing investment hoping it would "bounce back" knows that emotions often override logic when it comes to money. This is where behavioral finance comes in – a revolutionary field that combines psychology with economics to explain why we make irrational financial decisions, even when we know better.

The Two Systems of Your Financial Brain

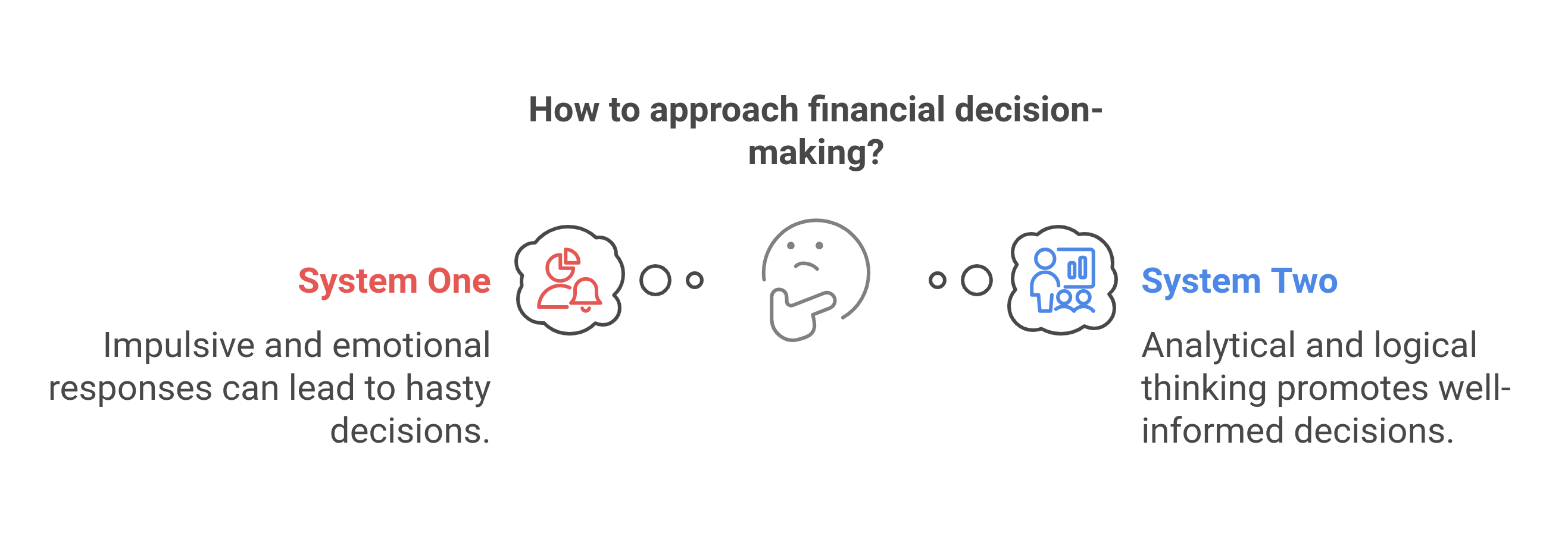

Nobel Prize-winning psychologist Daniel Kahneman, along with his colleague Amos Tversky, discovered that our brains process information using two distinct systems. Understanding these systems is crucial for making better financial decisions.

System 1 is your brain's fast, automatic, and emotional response center. It's great for catching a ball or jumping away from danger, but it can lead to knee-jerk financial decisions. When you see the stock market plunging and immediately want to sell everything, that's System 1 talking.

System 2 is your brain's slower, more analytical side. It's the part that can carefully evaluate investment options, analyze financial statements, and create long-term planning strategies. While System 2 generally makes better financial decisions, it requires more mental effort, which is why we often default to System 1's quick reactions.

Why Traditional Finance Theory Falls Short

Traditional finance theory assumes we're always using System 2 – carefully analyzing every financial decision with perfect rationality. However, behavioral finance recognizes that we frequently rely on System 1's emotional responses and mental shortcuts (called heuristics) when making financial choices.

Consider these common scenarios:

- Holding onto losing investments too long because selling would mean admitting a mistake

- Checking your investment portfolio more frequently during market volatility, leading to anxiety and poor decisions

- Following investment advice from social media without proper research because "everyone else is doing it"

- Feeling overconfident about your ability to pick winning stocks or time the market

These behaviors can't be explained by traditional finance theory, but behavioral finance helps us understand why they're so common.

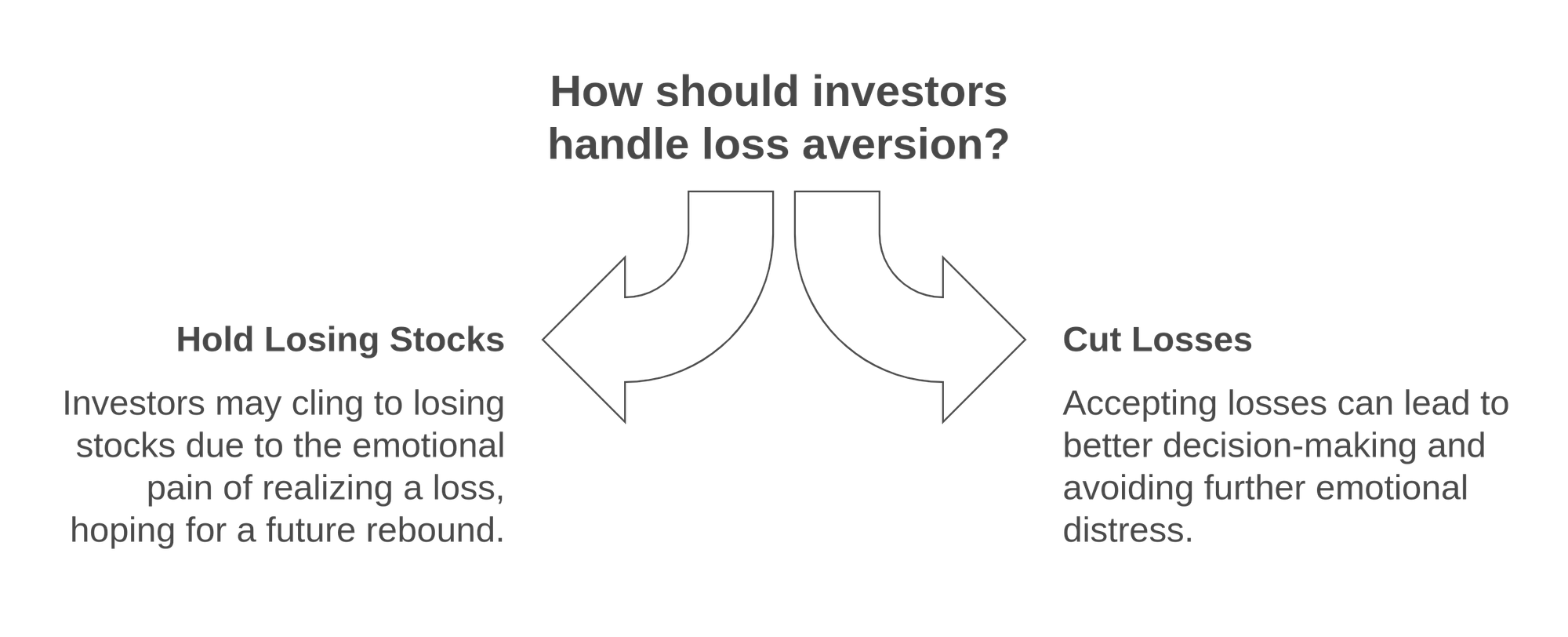

The Impact of Loss Aversion

One of the most powerful insights from behavioral finance is that humans feel the pain of losses much more intensely than the pleasure of equivalent gains. This phenomenon, called loss aversion, helps explain many irrational financial behaviors.

Imagine finding a $100 bill on the street versus losing $100 from your wallet. While the amount is the same, research shows that the emotional pain of losing $100 is roughly twice as powerful as the joy of finding $100. This psychological quirk leads investors to hold onto losing investments too long (hoping to avoid the pain of realizing a loss) while selling winning investments too early (to lock in gains and avoid the possibility of losing them).

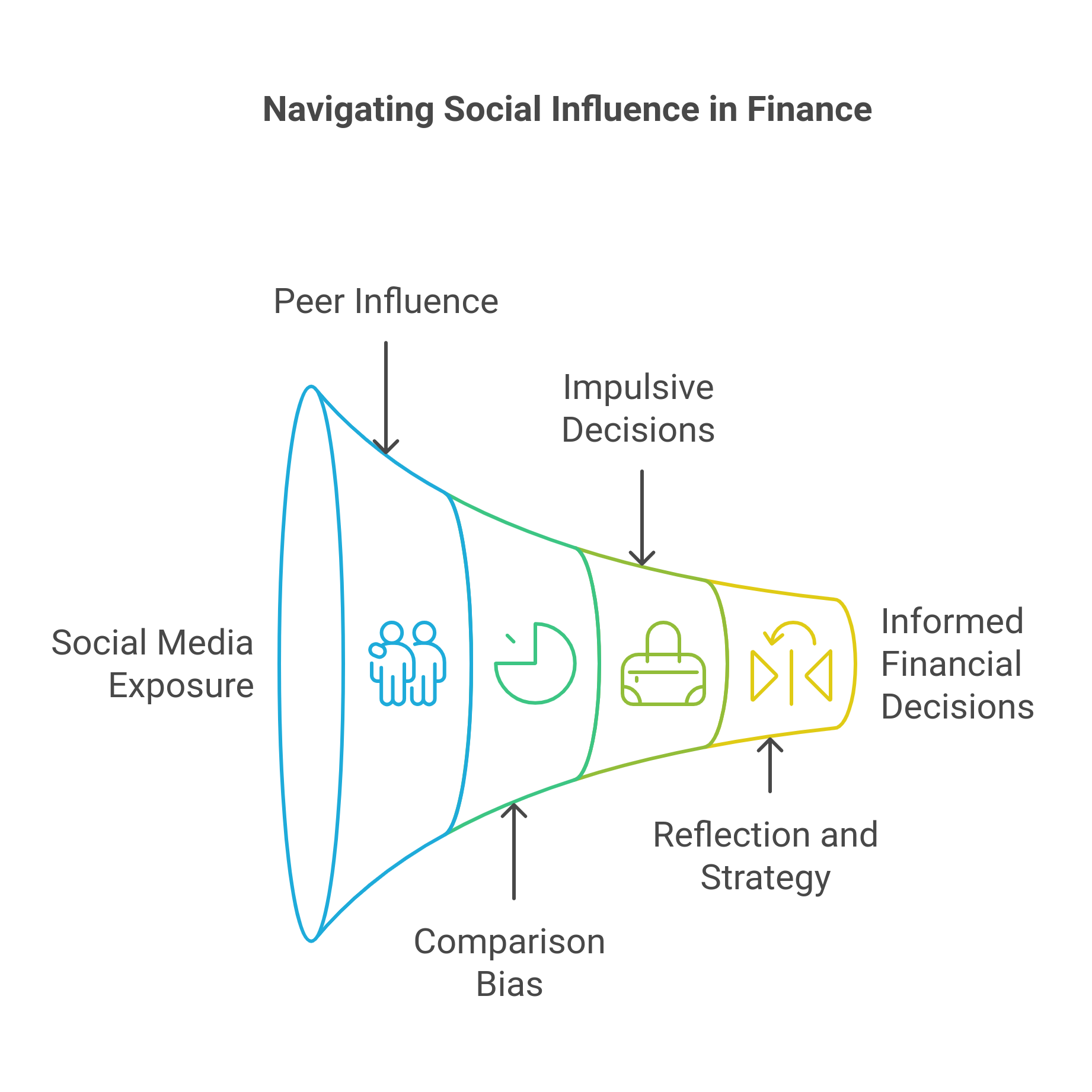

How Social Influence Shapes Our Financial Decisions

Human beings are inherently social creatures, and our financial decisions are heavily influenced by what others are doing. Social media has amplified this effect, creating what behavioral finance calls "relative comparison bias."

For example, seeing friends post about their investment successes or luxury purchases can lead to feelings of inadequacy and prompt poor financial decisions. This social pressure can cause people to take on too much risk, overspend, or invest in things they don't understand, all in an attempt to keep up with others.

Making Better Financial Decisions

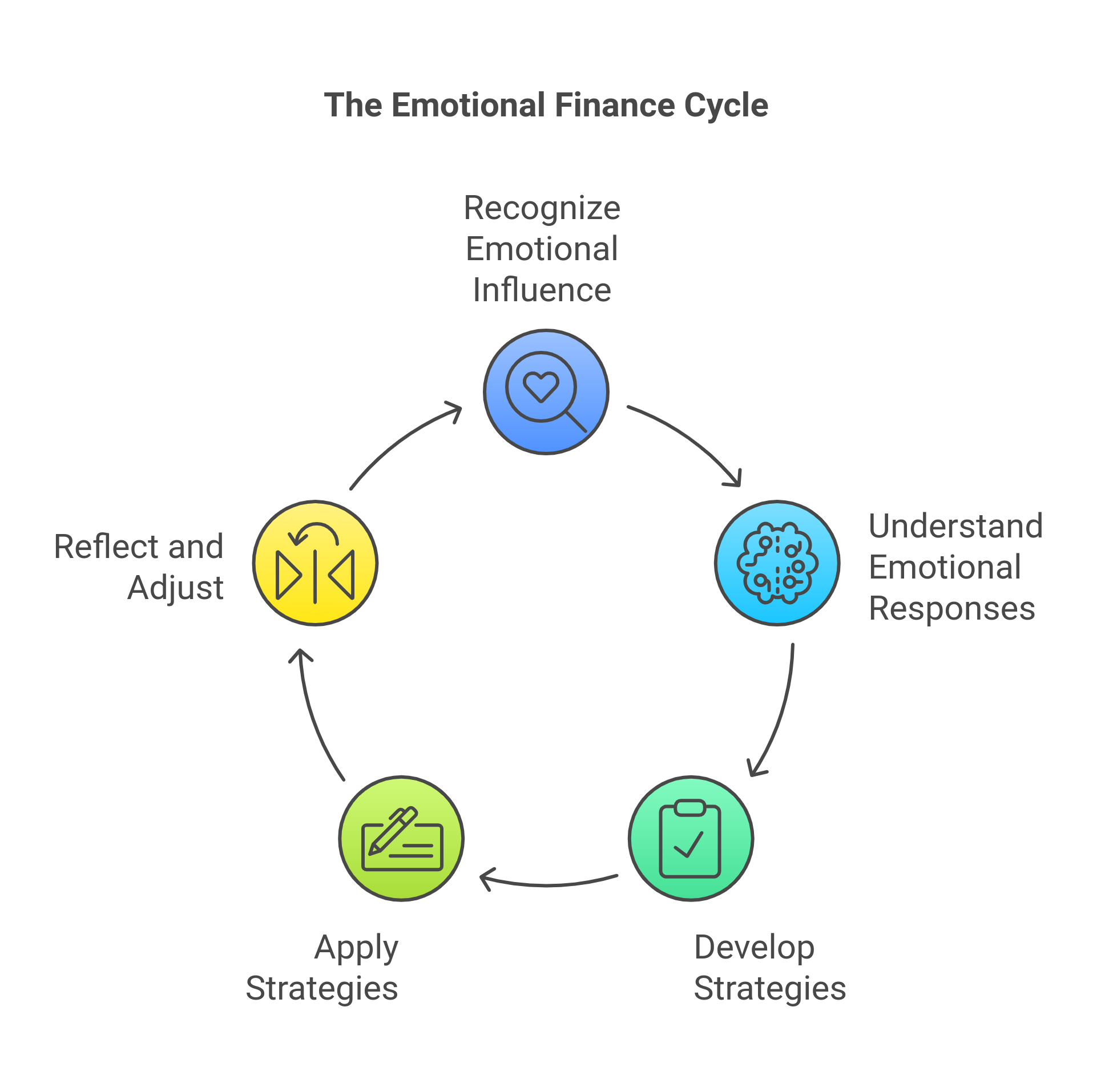

Understanding behavioral finance doesn't make us immune to these biases, but it does give us tools to make better decisions:

- Recognize the difference between System 1 and System 2 thinking. When making important financial decisions, take time to engage your analytical System 2 rather than acting on emotional System 1 impulses.

- Create a decision-making framework. Having a clear investment strategy and sticking to it can help override emotional biases during market volatility.

- Understand your own biases. Knowing that you're susceptible to loss aversion or social comparison can help you recognize and resist these tendencies.

- Focus on your personal financial goals rather than comparing yourself to others. Remember that social media often shows a distorted view of reality.

The Future of Financial Decision-Making

As we better understand how psychology influences our financial decisions, the field of behavioral finance continues to evolve. New technologies and research are helping us develop better tools and strategies to overcome our natural biases.

Remember, making rational financial decisions isn't about eliminating emotions – it's about understanding how they influence our choices and creating systems to make better decisions despite our human nature. By understanding behavioral finance, you can work with your brain's natural tendencies rather than against them, leading to better financial outcomes over time.