Jamie's Journey: A Lesson in Long-Term Savings and Compounding

Introduction

In the world of financial planning, the power of consistent, long-term saving cannot be overstated. Let's explore this crucial concept through the journey of Jamie, a young professional just starting her career.

Meet Jamie

Jamie, a recent college graduate, has just embarked on her exciting career path at a tech company. With an annual salary of $100,000 and an expected 3% raise each year, she's well-positioned to make wise financial decisions. At 22, Jamie stands at the threshold of a 40-year career, ripe with potential for planning a prosperous future.

Jamie's Savings Ethic

Known among her friends for her savvy money habits and frugal lifestyle, Jamie is committed to saving 30% of her income, totaling $30,000 annually. To simplify her financial plan, she decides to consistently save this fixed amount each year, putting aside $2,500 each month. With her disciplined approach, Jamie knows this habit, while initially challenging, will become more manageable over time, especially considering inflation and salary growth.

Jamie’s Smart Financial Distinction

Jamie understands the clear difference between saving and investing. She knows that saving is about ensuring liquid, stable growth without risking loss, while investing can offer higher returns but with greater uncertainty and potential for loss.

Jamie's Strategy

Determined to secure her financial future, Jamie opts to allocate the $30,000 for stable savings, while directing the incremental 3% salary raises towards more adventurous investments.

The Power of Compounding

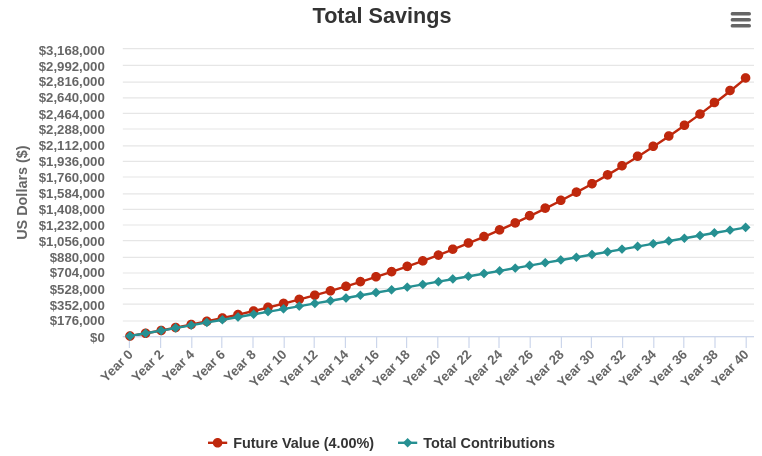

Jamie discovers an ideal financial instrument offering a 4% Internal Rate of Return (IRR). She commits to contributing $30,000 yearly to this asset. Curious about the future value of these savings, Jamie turns to a simple financial formula: =FV(rate, periods, -amount every period, starting value). In her case: FV(0.04, 40, -30000, 0). The negative sign on the $30,000 represents the outflow from her account.

After 40 years, at a steady IRR of 4%, Jamie's diligence pays off: her savings balloon to an impressive $2,850,765.47!

Conclusion

Jamie’s story is a testament to the power of starting early and staying consistent. Her approach, balancing risk with the security of guaranteed returns, exemplifies how disciplined saving can lead to substantial wealth accumulation over time.

Jamie’s journey is more than a financial success story; it’s a blueprint for young professionals looking to navigate the complexities of personal finance. If Jamie’s story inspires you to embark on your own journey of financial success, we’re here to guide you every step of the way.